2025 Window & Door Tax Credit

Access to federal tax incentives designed to reduce the cost of energy-efficient home improvements, including the installation of qualifying windows and exterior doors, is set to expire at the end of 2025. These incentives are part of the Energy Efficient Home Improvement Credit, which is available for improvements completed through December 31, 2025.

Overview of Tax Credits for Windows and Doors

Eligible taxpayers may claim a federal income tax credit equal to 30% of the cost of qualifying energy-efficient exterior windows and doors installed during the 2025 tax year, subject to item-specific and annual limits.

Window and Skylight Credit: Homeowners may receive a credit of up to 30% of the cost of qualifying windows and skylights, with a maximum credit of $600 per year for these items combined.

Exterior Door Credit: The tax credit for energy-efficient exterior doors is also 30 percent of cost, with a cap of $250 per door and a $500 total limit in a single tax year.

Credit Limits and Aggregation

These window and door credits are subject to the broader annual $1,200 limit applicable to qualified energy efficiency improvements under the Energy Efficient Home Improvement Credit. In addition to exterior doors, windows, and skylights, other qualifying improvements such as insulation or air sealing may contribute toward reaching the annual cap.

Eligibility and Requirements

To qualify, products must meet certain energy efficiency standards, typically demonstrated through ENERGY STAR or similar designations. Documentation of the manufacturer, model, and energy performance certification should be retained for tax filing. IRS Taxpayers claim the credit by completing IRS Form 5695 when filing their federal tax return for the year the improvements are placed in service.

Important Deadline

The Energy Efficient Home Improvement Credit, including the portion applicable to windows and doors, expires on December 31, 2025. Improvements must be installed and placed in service on or before this date to be eligible for the credit in the 2025 tax year.

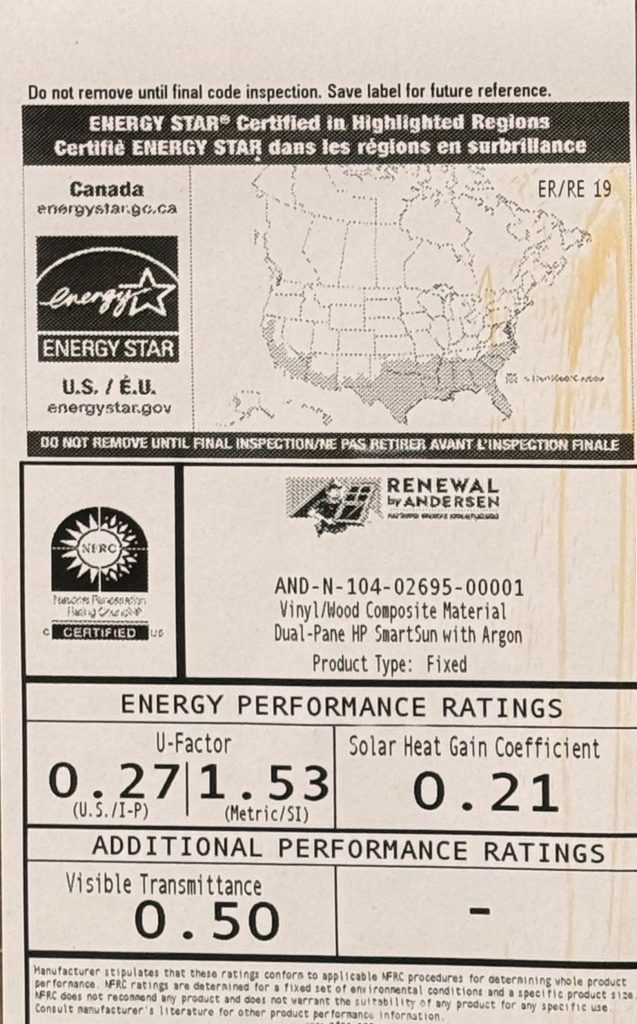

Check your NFRC label to establish if you meet required criteria.

Specific criteria for windows, skylights, and doors are listed below:

Windows and Skylights – Windows and skylights must meet ENERGY STAR Most Efficient criteria to qualify for tax credits under Section 25C. For more information about the Energy Star Most Efficient program and requirements by product and climate zone, see the EPA ENERGY STAR Most Efficient Website.

Exterior Doors – Doors must meet the ENERGY STAR criteria applicable to the climate zone in which the products are installed.

** For more information about ENERGY STAR Version 7.0 and requirements by climate zone, see the ENERGY STAR Version 7.0 Website.

Helpful information for our customers:

GreenSky financing tax credit information for Waunakee Remodeling Customers

For all windows purchased (not sold) prior to December 8th, 2025- you can find the CPD# (which is the AND- # at the top), also the U-Factor and SHGC on the window label.

For all windows purchased (not sold) on or after December 8th, 2025- you will now be able to find the CPD# on the order confirmation.